How to Calculate an Auto Loan: A Step-by-Step Guide

Calculating an auto loan can be a daunting task for many people, especially those who are new to the car buying process. However, it is an essential step in determining the amount of money you can afford to borrow and the monthly payments you will need to make. By understanding the basics of auto loan calculations, you can make informed decisions when shopping for a car.

When calculating an auto loan, there are several factors to consider, including the loan amount, interest rate, loan term, and down payment. The loan amount is the total amount of money you need to borrow to purchase the car. The interest rate is the percentage of the loan amount that you will pay in interest over the life of the loan. The loan term is the length of time you have to repay the loan, typically measured in months. Finally, the down payment is the amount of money you pay upfront towards the purchase price of the car.

To calculate an auto loan, you can use an online auto loan calculator or a spreadsheet program. These tools allow you to enter the loan amount, interest rate, loan term, and down payment to determine your monthly payment and total loan cost. By comparing different loan options, you can find the best auto loan for your needs and budget.

Understanding Auto Loans

What Is an Auto Loan?

An auto loan is a type of loan that is used to finance the purchase of a vehicle. The loan is secured by the vehicle, which means that if the borrower defaults on the loan, the lender can repossess the vehicle to recover the amount owed. Auto loans are typically offered by banks, credit unions, and other financial institutions.

Types of Auto Loans

There are two main types of auto loans: secured and unsecured. Secured auto loans are backed by collateral, which is usually the vehicle itself. Unsecured auto loans, on the other hand, are not backed by collateral and are typically offered to borrowers with good credit.

Another type of auto loan is a lease. With a lease, the borrower pays a monthly fee to use the vehicle for a set period of time, typically two to four years. At the end of the lease, the borrower can either return the vehicle or buy it outright.

Terms and Conditions

Auto loans have a number of terms and conditions that borrowers should be aware of. The interest rate on the loan will depend on the borrower’s credit score, the amount of the loan, and the length of the loan term. The loan term can range from a few months to several years, and the monthly payment will depend on the interest rate, the loan amount, and the length of the loan term.

Borrowers should also be aware of any fees associated with the loan, such as origination fees, prepayment penalties, and late payment fees. It is important to read the loan agreement carefully and ask questions if anything is unclear.

Preparation Before Calculating

Before calculating an auto loan, there are a few things that one needs to prepare for. This section will discuss the two main steps to take before calculating an auto loan: assessing your financial situation and determining your budget.

Assessing Your Financial Situation

The first step to take before calculating an auto loan is to assess your financial situation. This involves taking a look at your income, expenses, and overall financial health. It is important to have a good understanding of your finances before taking on any new debt.

To assess your financial situation, you can create a budget. A budget is a tool that helps you track your income and expenses. By creating a budget, you can see how much money you have coming in and going out each month. This can help you identify areas where you can cut back on expenses and save more money.

Another way to assess your financial situation is to check your credit score. Your credit score is a number that represents your creditworthiness. Lenders use your credit score to determine whether or not to approve your loan application and what interest rate to offer you. A higher credit score can result in lower interest rates, which can save you money in the long run.

Determining Your Budget

The second step to take before calculating an auto loan is to determine your budget. Your budget will help you figure out how much you can afford to spend on a car each month. This will help you avoid taking on more debt than you can handle.

To determine your budget, you should take a look at your monthly income and expenses. Subtract your expenses from your income to see how much money you have left over each month. This leftover money can be used to pay for your car loan.

It is important to keep in mind that a car loan is not the only expense associated with owning a car. You will also need to pay for gas, insurance, and maintenance. Make sure to factor these costs into your budget when determining how much you can afford to spend on a car each month.

By assessing your financial situation and determining your budget, you can better prepare yourself for calculating an auto loan. With a clear understanding of your finances, you can make informed decisions about how much to borrow and what interest rate to accept.

Components of an Auto Loan Calculation

When calculating an auto loan, there are several components that must be taken into consideration. These components include the principal amount, interest rate, loan term, down payment, trade-in value, and sales tax and fees.

Principal Amount

The principal amount is the total amount of money that you need to borrow in order to purchase the car. This amount includes the cost of the vehicle plus any additional fees, such as taxes and registration fees. The principal amount is the starting point for calculating your monthly payments.

Interest Rate

The interest rate is the percentage of the principal amount that you will pay in addition to the loan amount. This rate is determined by the lender and is based on several factors, such as your credit score and the length of the loan term. A higher interest rate will result in higher monthly payments.

Loan Term

The loan term is the length of time over which you will repay the loan. This term is typically expressed in months and can range from 24 to 84 months. A longer loan term will result in lower monthly payments, but you will end up paying more in interest over the life of the loan.

Down Payment

The down payment is the amount of money that you will pay upfront toward the purchase of the car. This amount is subtracted from the total cost of the vehicle and will reduce the principal amount of the loan. A larger down payment will result in lower monthly payments and less interest paid over the life of the loan.

Trade-In Value

If you are trading in a vehicle, the trade-in value will be subtracted from the total cost of the new car. This will reduce the principal amount of the loan and result in lower monthly payments. It is important to know the trade-in value of your vehicle before negotiating with the dealer.

Sales Tax and Fees

The sales tax and fees associated with the purchase of the car will also be included in the principal amount of the loan. These fees can include registration fees, documentation fees, and any other fees charged by the dealer. It is important to know the total cost of the vehicle, including all fees, before calculating your monthly payments.

Overall, understanding the components of an auto loan calculation is important in order to make an informed decision when purchasing a car. By taking into consideration the principal amount, interest rate, loan term, down payment, trade-in value, and sales tax and fees, you can calculate your monthly payments and determine the best loan option for your budget.

Calculating Your Monthly Payment

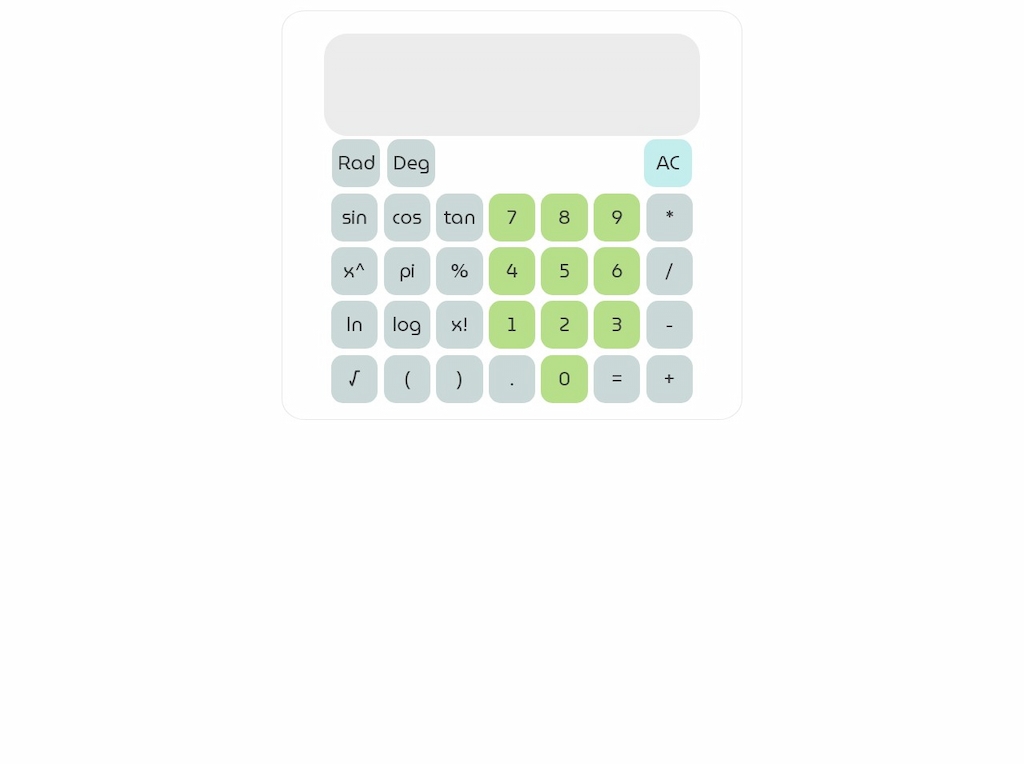

Using Auto Loan Calculators

One of the easiest and most accurate ways to calculate your monthly auto loan payment is by using one of the many auto loan calculators available online. These calculators allow you to input your loan amount, interest rate, loan term, and other relevant details to get an accurate monthly lump sum payment mortgage calculator estimate.

Some popular auto loan calculators include Auto Loan Calculator, NerdWallet’s Auto Loan Calculator, and Bank of America’s Auto Loan Calculator. Simply input your loan details and the calculator will do the rest.

Manual Calculation Method

If you prefer to calculate your monthly auto loan payment manually, there is a formula you can use. The formula is:

Monthly Payment = (Loan Amount x Interest Rate) / (1 – (1 + Interest Rate)^-Loan Term)

To use this formula, you’ll need to know your loan amount, interest rate, and loan term in months. For example, if you have a $20,000 loan at a 5% interest rate for 60 months, your monthly payment would be:

Monthly Payment = ($20,000 x 0.05) / (1 – (1 + 0.05)^-60)Monthly Payment = $377.42

Keep in mind that this formula doesn’t take into account any additional fees or taxes that may be added to your loan. It’s always a good idea to double-check your calculations with an auto loan calculator or with your lender.

Analyzing the Total Cost of the Loan

When it comes to taking out an auto loan, it’s important to understand the total cost of the loan. This includes both the principal (the amount you borrow) and the interest (the cost of borrowing that money). By analyzing the total cost of the loan, you can make an informed decision about whether the loan is affordable and fits within your budget.

Total Interest Paid

One important factor to consider when analyzing the total cost of an auto loan is the total interest paid. This is the amount of money you will pay in interest over the life of the loan. To calculate the total interest paid, you can use an auto loan calculator, such as NerdWallet’s auto loan calculator.

For example, let’s say you take out a $20,000 auto loan with a 5% interest rate and a 60-month term. According to the calculator, the total interest paid would be $2,645.92. This means that the total cost of the loan (including principal and interest) would be $22,645.92.

Amortization Schedule

Another useful tool for analyzing the total cost of an auto loan is an amortization schedule. This is a table that shows the breakdown of each payment over the life of the loan. It includes information such as the payment amount, the amount of interest paid, and the remaining balance of the loan.

An amortization schedule can help you understand how much of each payment goes towards paying off the principal and how much goes towards paying interest. This information can be useful if you want to pay off the loan early or if you want to see how much money you will save in interest by making extra payments.

Many auto loan calculators, such as Calculator.net’s auto loan calculator, include an amortization schedule as part of their output. By reviewing the schedule, you can get a better understanding of the total cost of the loan and how it breaks down over time.

Factors Affecting Your Loan

When it comes to calculating an auto loan, there are several factors that can impact the final amount of the loan. Understanding these factors can help you make informed decisions about your car purchase and loan terms.

Credit Score Impact

One of the most significant factors affecting your auto loan is your credit score. Your credit score is a measure of your creditworthiness, and lenders use it to determine your likelihood of repaying the loan. A higher credit score typically means lower interest rates and better loan terms, while a lower credit score may result in higher interest rates and less favorable loan terms. It is important to check your credit score before applying for an auto loan and take steps to improve it if necessary.

Loan Term Effects

The length of your loan term can also impact the total cost of your auto loan. A longer loan term may result in lower monthly payments, but it also means paying more in interest over the life of the loan. On the other hand, a shorter loan term may result in higher monthly payments but can save you money in interest charges. It is important to carefully consider the length of your loan term and choose one that fits your budget and financial goals.

Interest Rates Variations

Interest rates can also vary based on several factors, including your credit score, loan term, and the type of vehicle you are purchasing. It is important to shop around for the best interest rates and compare offers from multiple lenders. Even a small difference in interest rates can have a significant impact on the total cost of your auto loan.

By understanding these factors, you can make informed decisions about your auto loan and choose a loan that fits your budget and financial goals.

Tips for Auto Loan Calculation

Improving Credit Score

Before applying for an auto loan, it is important to check and improve the credit score. A good credit score can help get better loan terms and lower interest rates. This can be done by paying bills on time, reducing debt, and correcting any errors in the credit report. It is important to note that improving credit score may take time, so it is recommended to start the process early.

Negotiating Loan Terms

When applying for an auto loan, it is important to negotiate the loan terms with the lender. This can include the interest rate, loan duration, and down payment. A higher down payment can help reduce the loan amount and lower monthly payments. It is also important to shop around and compare different lenders to get the best loan terms.

Exploring Different Lenders

It is recommended to explore different lenders when applying for an auto loan. This can include banks, credit unions, and online lenders. Each lender may have different loan terms and interest rates, so it is important to compare and choose the best option. It is also recommended to check for any hidden fees or charges before finalizing the loan.

By following these tips, one can calculate an auto loan and get the best loan terms and interest rates.

Final Considerations Before Signing

When signing an auto loan contract, there are a few final considerations that borrowers should keep in mind to ensure they are making the best financial decision.

Reviewing the Contract

Before signing an auto loan contract, borrowers should carefully review all of the terms and conditions outlined in the agreement. This includes the loan amount, interest rate, loan term, and any additional fees or charges. Borrowers should also ensure that all of the information in the contract is accurate and matches the terms that were agreed upon during negotiations.

Understanding Prepayment Penalties

Some lenders may impose prepayment penalties if the borrower pays off the loan early. This penalty can be a percentage of the remaining balance or a flat fee. Borrowers should be aware of any prepayment penalties before signing the contract. If there is a prepayment penalty, borrowers should consider whether paying off the loan early is worth the additional cost.

Considering Additional Costs

In addition to the loan amount and interest rate, borrowers should also consider any additional costs associated with owning a vehicle. This includes insurance, maintenance, repairs, and fuel costs. Borrowers should factor these costs into their budget to ensure they can afford the loan payments and the additional expenses.

By reviewing the contract, understanding prepayment penalties, and considering additional costs, borrowers can make an informed decision about their auto loan. It is important to take the time to carefully consider all of the factors before signing the contract to ensure that the loan is the right fit for their financial situation.

Frequently Asked Questions

What factors affect the calculation of monthly payments on an auto loan?

Several factors affect the calculation of monthly payments on an auto loan, including the loan amount, interest rate, loan term, and down payment. The loan amount is the total amount borrowed to purchase the vehicle, while the interest rate is the percentage charged on the loan. The loan term is the length of time over which the loan is repaid, while the down payment is the amount paid upfront to reduce the loan amount. These factors are used to calculate the monthly payment on the auto loan.

How can you calculate the total interest payable over the life of an auto loan?

To calculate the total interest payable over the life of an auto loan, you need to know the loan amount, interest rate, and loan term. You can use an online auto loan calculator or a spreadsheet to calculate the total interest payable. Alternatively, you can use the formula: Total Interest = (Monthly Payment x Loan Term) – Loan Amount.

What is the formula for calculating an auto loan payment with a down payment?

The formula for calculating an auto loan payment with a down payment is: Monthly Payment = [(Loan Amount – Down Payment) x (Interest Rate/12)] / [1 – (1 + Interest Rate/12) ^ (-Loan Term in Months)]. This formula takes into account the loan amount, interest rate, loan term, and down payment to calculate the monthly payment on the auto loan.

How does one determine the amortization schedule for an auto loan?

The amortization schedule for an auto loan shows the breakdown of each payment into principal and interest. To determine the amortization schedule for an auto loan, you need to know the loan amount, interest rate, loan term, and payment frequency. You can use an online auto loan calculator or a spreadsheet to generate the amortization schedule.

What methods are used to calculate interest rates on car loans?

The most common method used to calculate interest rates on car loans is the Annual Percentage Rate (APR). The APR takes into account the interest rate, loan fees, and other charges associated with the loan. Other methods used to calculate interest rates on car loans include the simple interest method and the pre-computed interest method.

How do you figure out the loan value when financing a vehicle?

To figure out the loan value when financing a vehicle, you need to determine the purchase price of the vehicle, the down payment, and the trade-in value (if applicable). The loan value is the difference between the purchase price, down payment, and trade-in value (if applicable). You can use an online auto loan calculator or a spreadsheet to calculate the loan value.